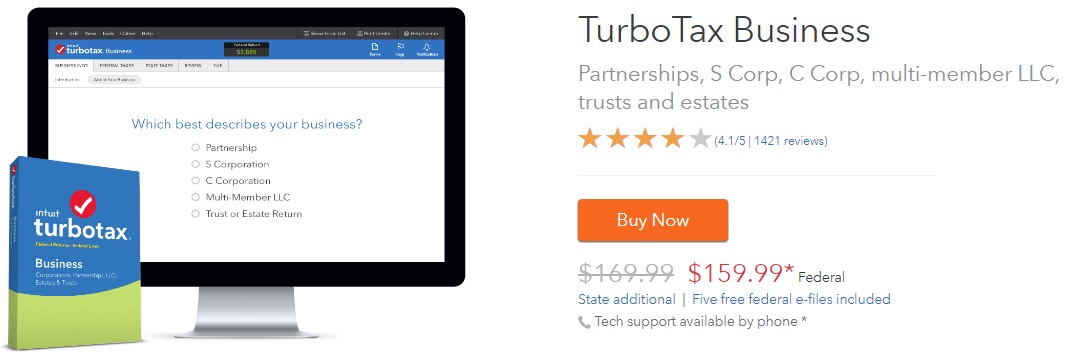

There are other tax software options, but they're designed for certain types of filers, such as Schedule C, so not all businesses are able to use them. This software doesn't ask conditional questions, so you'll have to deal with numerous questions as you prepare your return, including ones that don't apply to you. Pricing is for one federal tax return, with state returns costing additional fees per return. TaxAct Business comes in the following editions: This one costs less, but you can only file one tax return. This program provides step-by-step guidance to help you take advantage of all common self-employed deductions. TaxAct Freelancer edition is ideal for the following: This software isn't considered to be as user-friendly as TurboTax, but you can get started at no charge. The Premium & Business edition is best suited for C corporations, S corporations, partnerships, and multi-member LLCs. The Self-employed edition is ideal for freelancers and solopreneurs. However, with the higher cost comes the ability to file up to five tax returns for one price. You can file your personal taxes using H&R Block's Premium & Business edition and the Self-employed edition.Īlthough it's priced lower than TurboTax, H&R Block's tax software is still one of the more expensive options. With approximately 1,2000 offices around the country, H&R Block is a trusted name. You won't have to enter basic information that hasn't changed, such as your name and address. You can save time using the H&R Block software since you can easily import your previous year's tax return from other software (some other tax software brands import previous tax returns, but only if it was prepared on their software). You can file both business and personal taxes with the self-employed edition, however. One disadvantage to TurboTax is that you can't file personal taxes with the Business Edition. The Business Edition also offers suggestions for deductions based on entity type, and it checks for special deductions based on your industry. TurboTax Business Edition is more suitable for the following: You're able to enter more than one source of income. The TurboTax program offers suggestions on deductions that self-employed people usually take, such as vehicle and home office deductions.

#TURBOTAX S CORP SOFTWARE DRIVERS#

Typically, these products are easy to use and inexpensive. The following are a few popular tax software providers for small- to medium-sized businesses, independent contractors, freelancers, and sole proprietors.

For S corporations who employ shareholders who earn a salary, the business is responsible for payroll taxes, too.& If you operate an S corporation, you're responsible for filing form 1120S and Schedule K-1. S corporation tax software is useful for small business owners who need to prepare and file taxes without hiring a CPA.

0 kommentar(er)

0 kommentar(er)